(100509) Yesterday's red candle is likely a result of indicator noise. Today AMD re-tested the 0.382 Fibonacci support 5.12 (also today's low) again and the stock rallied off it and printed a long green candle in the process.

The head-and-shoulder pattern is still in play unless the stock can close above the 5.7 level. A failed head-and-shoulder pattern will be bullish for the stock and could potentially lead to a new high soon. A sharp 38.2% retracement after a strong rally is a good sign and could catapult the stock to ~8 level (161.8% Fibonacci extension). That is why the 5.12 support is very important for the stock price. However we need to watch the market

VERY carefully for signs of weakness

. AMD can't sail far against a strong current.

If the market correct further and red candles return, cash will be a good position to be in.

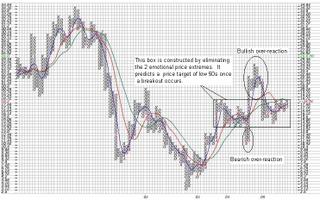

(100409) AMD's weekly chart remains bullish even with the recent pullback. On the daily chart however, there was a head-and-shoulder

with a neckline near ~5.6 which has been violated

on Thursday. Although the stock bounced of the .382 Fibonacci retracement level (5.12), it has left us with a red candle.

Depending on the broad market action next week, we could see a test of the next support around 4.8 (strong) which is the previous high, the 50% retracement, and the projected head-and-shoulder target. Further support levels are at 4.4 and 3.8 (gap) levels.

The broad market is about to roll over. How severe the correction will be remains to be determined. Comparing with SMH and INTC AMD's technicals are in a much better shape indicating its "hiden" strength. Friday's trading action also supports this notion. However it will not immune to a market crash. If the market attempts to rally early next week, it may be prudent to book some profit or lighten up positions.

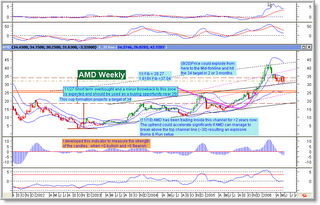

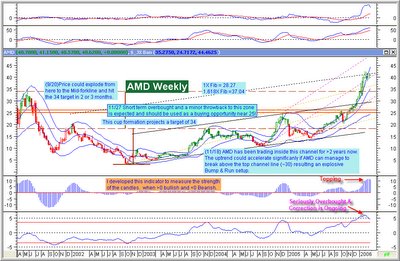

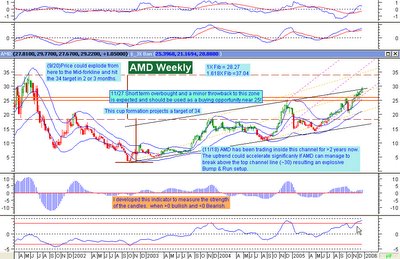

(092109) AMD took a much needed rest last week after making a new high. It retraced back to 5.4 level before rallied back and closed the week with a green candle at 5.7. The stock has gone up quite a bit from the breakaway gap and some sort of resting here is healthy. I would start to be a little bit concerned if it dropped back to below 5.0. Right now the weekly chart is looking good for bulls.

(091309) We got much more than we had asked for. AMD broke through the 4.7 resistance with the heaviest weekly trading volume of 2009 even though last week was a shortened 4-day week. Technically speaking this is a very important development and the trading action left us a very bullish weekly chart. As a chartist i don't care about and don't want to know why this stock is moving up. The price action last week is telling us someone is buying. Indeed AMD has outperformed SMH recently, an indication of strength and momentum. The broad market also rallied, however the rally last week was not convincing and needs to be monitored carefully. All four indicators are bullish on the weekly chart. Let's enjoy the chart below and see where it will lead us in the coming week. Good luck!